Can compound interest make you rich?

You’ve probably heard that compound interest is the Holy Grail in your quest for wealth creation. But, how long does it take for compound interest to truly kick in and do something for you?

If you’re anything like me, then you will want to make sure that your money (and compound interest) is working as hard for you… as you did working for your money.

What exactly is compound interest?

Compound interest is the interest paid not only on the deposit amount(s), but also on any accumulated interest already paid on the deposit amount(s). With simple interest, you are only getting paid interest on the amount of the deposit. With compound interest, you get to collect not only the interest paid on the deposit, but interest paid on interest, too!

This is where things get really interesting…

You working for your money (trading time for dollars) vs your money working for you (grows independently whether you’re there or not).

The more you learn about money, the better chance you have of making your money work hard for you. For example, if you were going to loan money to someone, which would make you more money? Charging simple or compound interest on the money you loan out? Let’s take a look…

Simple vs Compound interest

Compared to compound interest, simple interest is easier to calculate and easier to understand.

However, when it comes to investing, compound interest is better since it allows funds to grow at a faster rate than they would in an account with a simple interest rate.

Simple interest is interest only calculated on the principal amount. You are not earning any interest on any of the accumulated interest.

Compound interest is paying you not only on your principal, but also on any interest that accrues on the account. So, just as with simple interest, you get paid on your principal amount. However, in addition, compound interest will also pay interest on the accumulated interest as well.

For example, $1000 earning 5% simple interest would pay you $50 of interest to your account each year.

However, if you were earning 5% on $1000, compounding daily, you would earn $51.27 at end of the first year.

And after 15 years, you would have earned $350+ more in your account if you were compounding daily, instead of receiving only simple interest on your money.

Rule of 72

Have you ever wondered how long it would take for your money to grow to $100,000 or to a $1,000,000?

Let me ask you another question… Does it matter very much to you how much you make on your money? Is there that big of a difference in whether you earn 1% or 6% or 12% on your money? The short answer is… of course.

The Rule of 72 provides us a simple way to determine what your rate of return really means to you. In effect, the Rule of 72 will tell you how long it will take for your money to double (assuming a constant rate of return compounded over time).

Extremely easy to calculate… Simply divide your interest rate into 72 and you will know approximately how long it will take your money to double.

Why is this important?

Well, let’s take a look at several examples…

We’ll assume that your money ($10,000) will be saved or invested over the normal course of a 40-year working career. And in this example, we are not adding any additional money.

Example 1:

2% generous savings interest rate => 72 divided by 2 = 36. Your money would double 1 time over the next 36 years. So, at the end of 40 years, your $10,000 would grow to a little more than $20,000.

- $ 10,000 x 2 = $20,000

Example 2:

6% interest rate => 72 divided by 6 =12. Your money doubles every 12 years. So, during the 40 year period, your money would double 3 times, and your $10,000 would be worth ~$80,000.

- $ 10,000 x 2 = $20,000;

- $ 20,000 x 2 = $40,000;

- $ 40,000 x 2 = $80,000.

Example 3:

8% interest rate => 72 divided by 8 = 9. Your money would double 4 times (every 9 years). At the end of 40 years, your money would grow to ~$160,000.

- $ 10,000 x 2 = $20,000

- $ 20,000 x 2 = $40,000;

- $ 40,000 x 2 = $80,000;

- $ 80,000 x 2 = $160,000.

Can you see how important it might be to get your money working harder for you.

WARNING: Generally, when there’s the opportunity to earn a higher rate of return, there’s potential risk for loss to your principal. That’s a conversation for another day.

Now, let’s take a look at credit card interest that may be paid to the bank. Some credit cards may charge less, but there are credit cards that will also charge more.

For this example, you owed $10,000 on a credit card that’s charging an 18% interest rate => 72 divided by 18 = 4. Their money would double every 4 years, or 10 times over the next 40 years. At the end of 40 years, assuming no payments were made, you would owe the bank more than $10+M!

Example 4: 18% (doubles 10 times | every 4 years)

At 18%, compounding annually, $10,000 grows to $10,240,000 over 40 years – How good are banks at growing their money using compound interest? What’s the interest rate on your credit cards?

Penny Doubling Every Day for 30 Days

Here’s another example of the power of compound interest:

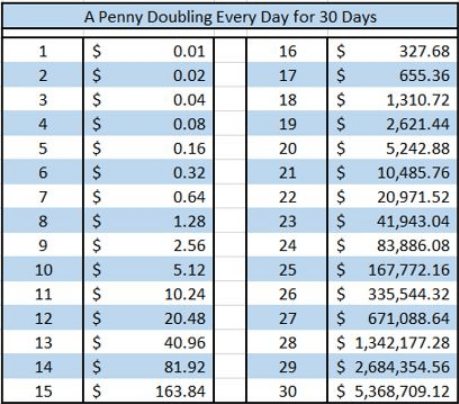

If you were given the option of working for $1,000 per day for 30 days… or starting with a penny the first day, and then having that penny double every day over the next 30 days, which would you choose?

With the first choice, you know that you will have earned $30,000 over 30 days.

With the second choice, it seems like you wouldn’t make very much when you start with only a penny.

Let’s take a look:

Penny doubling for 30 days vs $1,000 / day, every day for 30 days

On the 10th day, you’re only making $5.12.

Where things get interesting in my mind is around day 25.

But what would happen if you ALWAYS took your money out and spent it after 15 days? 20 days? You would never get to experience the true magical power of compounding interest.

And that’s the difficult part… to experience the full potential of what compounding interest can do for you and your family you need time… a long time!

Compound interest may be more about leaving a legacy that can have a profound effect on your family for many generations!

Cons of Compound Interest

- Takes a long time for it to work for you

- Compounding can also work against you if you have loans that carry very high-interest rates, such as credit card debt.

- A credit card balance of $20,000 carried at an interest rate of 20% compounded monthly would result in total compound interest of $4,388 over one year or about $365 per month.

- Compound interest is a 30+ year plan – and that’s pretty far away.

On the positive side, the magic of compounding can work to your advantage when it comes to your investments and can be a potent factor in wealth creation.

And exponential growth from compounding interest is also important in mitigating wealth-eroding factors, like increases in the cost of living, inflation, and the loss of purchasing power.

Do you have the power of compounding working in your favor… and not against you?

Put your money to work for you!

Leave a Reply