What do you want your retirement to be like? Take some time to write down what your retirement lifestyle looks and feels like. Describe it in full, vivid detail.

What will your typical day in retirement feel like? What will it look like? What will it sound like? Be as descriptive as you can and write…

“A Day In The Life of My Retirement”.

Is it everything you hoped and dreamed?

I hope so!

You’ve spent your whole life working towards that moment. You’ve been planning and saving for 30-40 years. Right?

Building a retirement income strategy starts with taking an honest look at what you want retirement to be like. Understand what’s important to you… your priorities… and the trade-offs. What price are you willing to pay?

Start penciling out the cost of your retirement lifestyle. What do you currently have set aside for retirement? How you will bridge the gap?

How much will you put away? Where will you save and invest it?

Your ultimate goal is to replace your paycheck income with sustainable, reliable retirement income!

What is Retirement Planning?

According to Investopedia, retirement planning is the process of determining retirement income goals and the actions and decisions necessary to achieve those goals.

The retirement planning process includes identifying sources of income, estimating expenses, implementing a savings program, and managing your assets and the associated risks.

What are your financial strategies for saving and investing? How you will access your retirement savings to provide the retirement lifestyle you desire? How will you turn your retirement assets into income to pay your bills and expenses during retirement?

Planning for retirement is a life-long process.

You will want to continue evaluating your progress and making adjustments along the way to make sure your reach your retirement goals

The retirement planning process is not only about being financially prepared, but also emotionally prepared … How will you handle not going to work every day? How will you fill your days now that you’re not going to work?

3-Legged Stool

Retirement income generally comes from 3 different sources: retirement savings, pensions and social security.

Retirement Savings >> This is your responsibility now. Once common, defined benefit plans (pensions) in the private sector are rare, and have been replaced by defined contribution plans (e.g., 401k). Most private companies choose to offer 401k – type plans because they are less expensive and complex to manage than traditional pension plans.

If you have a 401k –type plan, it’s your job to make sure that you’ve saved enough. And even more importantly, you must absolutely manage the risk of your portfolio. In years past, if you had a pension, all you had to do was show up for work and do your job. When you retired, your pension was waiting for you.

Now, if you want to make sure that you have money during your retirement, you not only have to put the money away for your future, but you also need to manage it as well.

With little to no financial education, this is a most difficult problem to solve! Are you up to the task? Have you thought about how you are going to turn your retirement savings into a predictable stream of income over your lifetime?

What happens if the market drops significantly? Particularly if you have just ‘enough’. Will you have to go back to work? Reduce your lifestyle? Live frugally for fear of running out? Or ignore it and pretend nothing happened… spend freely (until it too late)?

Very little room for error!

How will taxes effect your retirement income? Is Uncle Sam your business partner? If you took advantage of pre-tax contributions to your retirement accounts, Uncle Sam will want its share when you take distributions from your retirement accounts. If your contributions were post-tax (Roth), your distributions could come out tax-free.

How much of your retirement savings is exposed to the stock market rollercoaster?

Are you more concerned about missing out on a market rally or… being exposed to a market crash?

If your retirement savings drop in value due to market volatility, will you have time for the value of your retirement savings to recover?

Pension >> As mentioned earlier, many companies have switched from providing pensions to offering retirement accounts (and transferring the associated risk to their employees). If you’re due a pension, you will want to keep aware of the financial stability of your particular pension plan.

Also, if you’re married, did you select the survivor option? Take the time to understand your options and choose what’s best for you and your family.

Social Security >> Social security was never meant to be your sole source of retirement income (although for many, it is)… It was supposed to be a safety net.

Many planning for retirement are not counting on Social Security being around. It makes sense to plan for the worst and hope for the best. What would your retirement look like if Social Security was not available?

But what if Social Security is still around and you can take advantage of the benefits that you’ve earned and accrued? Would it make sense to know how you can maximize your benefits?

One way to maximize and optimize Social Security benefits is by claiming as late as possible (up to age 70). However, like most financial decisions, there is not a one size fits all.

There may be reasons to claim your benefits as early as age 62 (due to poor health, need money to survive, or maybe you strongly believe Social Security won’t be around for very long, etc.)

And there may be arguments that would point to optimize your payout by delaying benefits until age 70 (expected longevity, have other income to cover lifestyle, want Social Security to provide larger monthly income for life).

The answer may be very different if you’re single and only have yourself to think about. Compared to a married couple that may have options to maximize their payout based on both of their benefits.

If you are married, take some time to understand the difference between the benefits you’ve earned vs spousal benefits. Does it make sense to claim your spousal benefits early while letting your primary benefits grow… and then switch?

Take some time, ask questions and do some research. What you don’t know WILL potentially cost you thousands (or hundreds of thousands) over your lifetime!

Let me ask you this… is it a big financial mistake or a little financial mistake if you claim your benefits early and live well into your 90’s? Or if you claim at age 70 and die early?

Again, it’s important that you do a little research for yourself and make an educated decision for you and your family.

Do you know how much you are supposed to get? At what age? Do you know your Full Retirement Age (FRA)? You can get the answers to all of these questions and more when you register for your account on the Social Security website. Go to ssa.gov and register.

Another good source of information regarding retirement and Social Security is the Center for Retirement Research at Boston College .

Some of the advantages of Social Security:

- Indexed for inflation

- Sustainable and reliable income for your lifetime

- Protects against living too long (meaning it never runs out)

- Even if the stock market crashes, your monthly payments never decrease!

- Don’t have to think about

- Portion of the benefit may be exempt from federal tax and many states don’t tax Social Security income

When Should You Start Planning for Retirement?

The earlier you start planning, the more time your money has to grow. However, regardless of how old you are… today’s a great day to start! It’s never too early… or too late!

When are you planning to retire?

How much are you putting away for retirement?

What do you want your retirement to look like? Are you interested in maintaining your present quality of life?

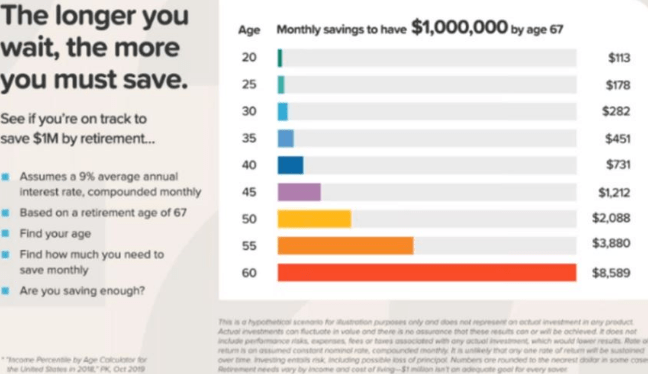

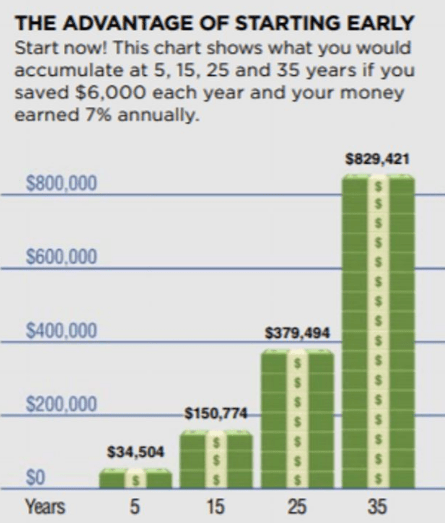

Start planning now to take advantage of the power of compounding – the younger you are when you start the greater chance that you will experience the true power of compounding.

The more time you have to execute your plan for retirement, the greater the odds will be that you will be able to accomplish your financial goals.

In this example, 9% is high; however, it shows the advantage of starting young and the true ‘cost’ of procrastination.

Where Should You Save Your Retirement Dollars?

Retirement accounts offer a way for you to grow your retirement dollars tax-deferred… meaning you won’t pay taxes on the investment gains until you withdraw the money for your retirement.

Most retirement accounts will require you to keep your money in the account until you’re 59 ½. If you withdraw it before 59 ½, you will not only pay taxes on the withdrawal, but you will also pay a 10% penalty. (There are some exceptions to this penalty).

If you’re an employee, check to see what retirement account options are available to you. Most large companies will have a 401(k) plan available to you. The advantage here is that you can have your contributions taken directly out of your paycheck. So, you can effectively set it and forget it.

Your company may even offer to “match” a percentage of your contribution. If they do offer a “match”, be sure that you contribute enough to take advantage of the “free” money.

If your employer does not offer a retirement account, you can look into opening up an Individual Retirement Account (IRA).

Traditional vs Roth

The primary difference between a Traditional and Roth retirement account is when you receive the tax benefit. With a Traditional 401(k) or IRA, you can actually deduct your contribution from your income to receive the tax benefit now, but you will have to pay taxes on your withdrawals later.

With a Roth 401(k) or IRA, you make your contributions with after-tax money, but your withdrawals may come out completely tax-free.

You will want to do a little research to determine what retirement accounts you might be available to you as well as the contribution limits for each. If you’re a business owner, there are different retirement accounts available to you, as well. Retirement accounts generally offer tax advantaged contributions.

Here is a short list of some of the retirement accounts:

- Traditional 401(k) – ideally with employer match

- Roth 401(k)

- Solo 401(k)

- 403(b)

- 457

- Traditional IRA

- Roth IRA

- SEP-IRA

- SIMPLE IRA

Retirement Savings Options

Determining what kind of retirement account (IRA, 401k, etc) is just the first decision you will need to make. Even more important will be what you will actually be saving or investing in.

Just to be clear, the retirement account (IRA, 401k, etc) is NOT the actual investment. It is a place to hold your investments that provides special tax advantages.

For most 401k accounts, your employer will have a list of investments you can choose from, typically mutual funds and company stock.

If you’re contributing to any IRA, your investment options are generally much broader… including CDs, stocks, bonds, mutual funds, annuities, unit investment trusts (UITs), exchange traded funds (ETFs) and even real estate (in self-directed accounts).

Risk and Return

Your “Return” is defined as the money you expect to earn on your investment. “Risk” is the chance that your actual return may be different that you might expect. “Risk” also may include the amount of volatility (how much the value of your investment goes up or down) in any particular investment.

When you are investing your money, especially over a long period of time, you will want to position yourself to earn as high of a return as you can, with a reasonable amount of risk.

Do you remember the Rule of 72?

For example: You could place your retirement savings ($100,000 for example) in a very safe Certificate of Deposit (CD) at a bank and earn 1%. Over the next 36 years you can expect that account to be worth ~$150,000.

But what if you could earn 6%? Your $100,000 would be worth ~$800,000.

Or 8%? Your account would be worth ~$1,600,000.

The difference between earning 1% and 8% over 36 years is $1,450,000! Is it worth taking on some risk for the potential to earn significantly more over time? Absolutely!

WARNING: The amount of risk you expose yourself to should be drastically differently when you’re 30 years old and when you’re 60 years old.

Generating Cash Flows for Life

Now comes the fun part! It’s time to estimate your retirement needs based on your current income and expenses, and how you think those expenses might change in retirement.

Save early, save often! Remember the time value of money.

When many companies abandoned their defined benefit plans (pensions) in favor of defined contribution plans (401(k), 403(b), 457, etc), they effectively transferred the responsibility of determining how to turn your pile of money into monthly income from them to you!

If you do a great job, you’ll have enough income to last your lifetime. But what if you don’t?

Turning Your Savings Into Cash Flow – The 4% Rule

The “four percent rule” is a widely accepted financial rule of thumb. It states that your savings should last through 30 years of retirement if you limit your withdrawals to 4% of your nest egg during the first year of retirement and then adjust each year thereafter for inflation.

What this means is that if you have $500,000 in your retirement accounts when you retire, you should be able to withdraw $20,000 ($500,000 x 4%) during that year.

Does this rule still hold true if the market drops significantly in the first several years of retirement? That’s a tough question! When the market dropped in 2008, there were many financial planners telling their clients that they might want to consider delaying retirement!? Or go back to work if they were already retired!

Growth vs Safety >> Your goal for your retirement savings should change as you get closer to retirement. You should expect to transition from trying to maximize the growth and your investment return to securing a happy and comfortable return for your future. It’s human nature to always want to make a little more… but at what cost?

Risk Management >> How much of your retirement savings are you willing to risk after you’ve retired? 5%? 10%? 20%. If you have $500,000 set aside, those percentages translate from $25,000 – $100,000 in real dollars! It’s important to not only look at the percentage you might be willing to risk, but also to what that translates into real ‘lost’ dollars.

Money Management Plan >> how will you make sure that your retirement dollars last your lifetime?

Understand that “Bear” markets are a normal part of the investment life cycle and can reduce your investments in the market by 25%+ and take years for the market to recover. According to Forbes, in the last 20 years we’ve seen 2 recessions and recoveries, and are in the middle of the COVID-19 pandemic. The 2000’s Recession (Dec 1999 – Sep 2002) saw the market drop 34%. And during the Great Recession (Oct 2007 – Feb 2009) the market declined 49%.

How will you protect your assets? If you run out, you won’t typically have a chance to replenish whatever was lost. Will there be a time when you want guaranteed income?

How Much Do You Need?

How will you replace your current paycheck with retirement paycheck?

Don’t underestimate how much you’ll need to enjoy your retirement lifestyle.

Most experts say your retirement income should be about 80% of your final pre-retirement salary. That means if you make $100,000 annually at retirement, you need at least $80,000 per year to have a comfortable lifestyle after leaving the workforce.

Let’s find out if this makes sense for you!

Retirement Cash Flow Projections

To determine a realistic starting point for you, let’s start by identifying the critical pieces of your retirement plan and putting you in the best position for success… INCOME and EXPENSES.

(Click here to get access to the worksheets for your personal financial statement, which include a cash flow statement and net worth statement. This will help you to identify your current assets)

INCOME

Retirement Assets – At some point, you will need to determine how best to turn your assets into income.

- You might consider placing 2-3 years of anticipated income in a conservative investment where the primary objective is capital preservation. This would allow you to protect your immediate income from market fluctuations; and your remaining portfolio may continue to be invested in the market to provide growth opportunities. You must manage the risk in your portfolio to reduce the potential for loss due to market declines.

- Dividends and interest

- Dividend-paying stocks

- Bond interest

- CD interest

- Investment property income

- Residual or passive income from ongoing business(es)

- Annuities ( Looking for guarantees? Annuities can provide guaranteed income for life)

- Permanent life insurance

Pension – If you will be receiving a pension, then take the time to understand your benefits. Also, will there be income for your life only; or is there a spousal benefit?

Social security – Register for your account at ssa.gov to estimate what your Social Security benefits may be.

EXPENSES – future (monthly and one-time)

- Plan on spending less on these job-related expenses:

- Commuting costs

- Retirement plan contributions (although if possible, try to continue to add to your savings)

- Hopefully, no more mortgage payments?

- Car(s) paid in full?

- Ideally, credit card debt is eliminated?

- Plan on spending more on:

- Health care* (even with Medicare)

- Travel

- More time to spend money

- Add in any anticipated major bills

- Bucket list trips

- New car

- Home renovations, etc.

When can you retire?

It really doesn’t take age to retire… it takes income from sources that do NOT require you to be present to get paid!

For many, the determining factor of when you can retire will be your ability to start drawing on a pension or Social Security.

The earliest you can claim Social Security is at 62, but you’ll be sacrificing a portion of your benefits if you claim early.

The latest you will want to claim Social Security is at 70. It’s important for you to understand the difference in the amount of your benefit because you will be locking your benefit in for your lifetime.

Many individuals who stop working before age 62 apply for Social Security as quickly as possible. Let’s take a look at an example of what the benefit would be at age 62 vs age 70…

Assumption: If your Social Security benefit at full retirement age is $1,000 per month…

- If you claimed your benefit at age 62, you would receive $750/month.

- If you claimed at your Full Retirement Age (age 66 in this example), you would receive $1000 per month.

- If you waited and claimed at age 70, you would receive $1,320 (almost twice as much as at age 62)

You can do your own break-even analysis to determine what makes the most sense for you.

For married couples keep in mind that if there is an age or health difference then upon the first death, the surviving spouse will continue to receive the higher of the two Social Security benefits (not both).

For example, if one spouse’s benefit is $1475 and the other spouse’s benefit is $1200, then upon the death of either one, the higher benefit ($1475) will continue to be paid and the lesser benefit ($1200) will disappear.

Go to ssa.gov to help you determine what age makes sense for you.

It’s critical that you do your homework so you can decide when it makes sense for you to retire…

When will you have enough money coming in to replace the income you’re getting from work?

Do you have control of when you will ‘retire’. Who do you know that was ‘offered’ early retirement? Did they really have a choice? What if your company makes the decision for you?

Without proper planning, retirement may be a time of downsizing… your home, your income and your expectations.

Plan for the worst and hope for the best!

What’s Your Plan?

So, what’s your plan for retirement? Will you quit ‘cold-turkey’? Or will you move slowly into retirement? Will you find a stress-free part-time job that provides some income and social interaction? Or go straight to your retirement savings, pension and/or Social Security?

By bringing in some income, you can give your retirement savings more time to grow… or less dollars withdrawn… and hopefully make it last longer for you. This might also give you time to adjust to your retirement lifestyle.

Do you have a hobby that you enjoy… that may provide an income opportunity? If you enjoy golf, is there a job at the local golf club that could provide some income (as well as free golf)?

Have you been able to clear out all of your debt? (Mortgage, cars, credit card?)

How’s your health? What’s your plan for managing your health? Eating well, exercising, keeping physically active and engaged?

What’s your cash flow plan? What income will you rely on… and when? What expenses will go away? What new expenses might show up?

Your Retirement Plan is a living document. Initially you will want to review and update your plan each year. And as you get closer to retirement, it may warrant a review every quarter or month.

The better your plan and execute, the more likely you’ll be able to have a retirement lifestyle that you can truly enjoy!

Will You Have Enough?

Take a look at your current monthly spending. What are the biggest chunks (besides your kids!)? Your mortgage? Car payments? Credit card payments? What would your retirement spending look like if these monthly obligations were completely paid off? Will you make that a part of your retirement plan?

Let’s take a look at what the experts say you should have set aside by certain ages…

In a Forbes article on “How Much Should You Have Saved By Age?”

T. Rowe Price recommends you have:

- Age 30 ½ times your current salary

- Age 35 1 times your salary

- Age 40 2 times your salary

- Age 45 3 times your salary

- Age 50 5 times your salary

- Age 55 7 times your salary

- Age 60 9 times your salary

- Age 65 11 times your salary

According to T. Rowe Price, if you are earning $50,000 by age 30, you should have $25,000 banked for retirement. By age 40, you should have twice your annual salary. By age 50, five times your salary; by age 60, nine times, and by age 65, eleven times. If you reach 65 years old and are earning $75,000 per year, you should have $825,000 saved.

Now, keep in mind that these are just guidelines. If you’re running below the guidelines, ask yourself if it makes sense to increase the amount you’re setting aside for retirement. Or re-prioritize your spending. If you’re running ahead, it doesn’t mean you can take your foot off the gas.

The tough part is finding the balance between enjoying your lifestyle today, but also putting aside enough so that you can also enjoy your retirement lifestyle!

Keep in mind that you will be spending about as long in retirement as you did working.

The key to a secure retirement is to plan ahead.

What assets are you building to provide your income streams during retirement?

What If You Don’t Have Enough?

- Work a few more years

- WARNING: if you’re still working and you decide to start receiving you Social Security benefit before your full retirement age (FRA), the amount of your earnings may actually reduce your current Social Security benefit. (Check with Social Security to determine the earned income limits.) Once you reach your Full Retirement Age, the amount you earn will not have any negative effect on your Social Security benefit.

- Increase your portion going into retirement savings

- Cut back on unnecessary spending

- Down-size to more affordable home

- Retire somewhere with a lower cost of living

- Wait until your full retirement age (FRA) or even delay your Social Security benefits until age 70 to maximize your monthly Social Security benefits

- Part-time work

- Gig economy

- Side hustle or home-based business

Your Retirement Plan Should Evolve

What’s the ultimate goal for your retirement plan? One of the greatest fears of retirement is running out of money! What are you going to do to make sure that doesn’t happen to you?

Is your plan to spend your last dollar with your last breath? Spending your children’s inheritance? Or are you more interested in building a legacy to pass on to future generations?

There will be times when your primary objective for your retirement plan is growth. And there will come a time when it’s more important to preserve what you have. You will need to know when it’s time to push hard and when it’s time to chill.

Ideally, your retirement will mean financial freedom for you! With proper planning, you will have enough income coming in to cover your monthly expenses, and allow you to do whatever you want, wherever you want, and with whomever you want!

RECAP:

- Over time, compound interest and tax deferrals will accelerate your growth in retirement accounts

- Make sure you contribute enough to get any matching company contributions

- How long would you need to stay in your retirement plan to get that money (when are you 100% vested)

- Find out if your employer has a traditional pension plan and if you’re covered; find out what your benefit is worth

- How you save can be as important as how much you save (understand taxes and fees)

- Keep retirement savings and use it only for retirement (you CANNOT borrow from anywhere to fund your retirement!)

- If you do change jobs, find out your options on how best to keep your retirement savings in a retirement account (generally, you’re able to ‘roll-over’ your retirement savings into another retirement savings account, without penalties or taxes)

- Traditional IRA vs Roth IRA (pay taxes now or later)

- Find out what your Social Security benefits will be

- Take responsibility for your retirement plan… understand what you’re invested in… ask questions!

- Delay social security (max 70)

- Good health >> provides maximum income for life

- Poor health >> can start receiving social security as early as age 62; however, much lower income (for life)

- One strategy for married couples >> if either spouse had significantly higher income and will be receiving higher Social Security; have lower earning spouse start their Social Security benefit at 62 and delay higher earning spouse until 70. Then when the higher earning spouse starts receiving their benefit, lower earning spouse can switch their benefit… claim spousal benefit (50% of higher spouse’s benefit) for lifetime (understand the difference between your personal benefit and your spousal benefit).

- Another reason for higher income spouse to delay is to compensate for too little life insurance…

- Work part-time

- Take advantage of gig economy | start a side hustle

- Start home-base (or virtual business)

- Ultimately, may need to downsize retirement lifestyle

- Can you get there on your own?

Make saving for retirement a top priority.

Retirement can be wonderful, but only if you plan for it!

You only get one shot… no do-overs!

May your retirement be glorious! Enjoy!

Leave a Reply