You don’t realize it yet, but in the next few minutes you’re going to hear some straight talk about life insurance.

To start with, do you have life insurance? Are there people you love that will suffer financially when you die? (I didn’t say ‘if’… I said ‘when’).

Death is part of our lifecycle. We know it’s going to happen… we just don’t know when. We assume that it won’t happen to us for a long, long time. And hopefully, that’s true.

But let me ask you this… Would you rather be 10 or 20 years early in buying life insurance? Or 5 minutes too late?

The purpose for any kind of insurance is to help protect you from financial loss. Insurance is here to help you manage the risk against the possibility of something happening that could wipe out you and your family financially.

What’s the possibility of death? 100%… Death will ultimately visit EVERYONE. Life insurance is one of the few types of insurance that will eventually pay off for you and your family.

Think about it… Have you ever filed a claim on your car insurance? Maybe you have… maybe you haven’t. How about your homeowner’s coverage? Well, depending on the type of life insurance you choose, there will be a 100% chance on your policy paying out to your beneficiaries.

If you have a mortgage on your home, the lender will absolutely require you to have insurance on your property. Why? To protect the lender that holds your mortgage.

If you have a loan on your vehicle, the lender will absolutely require you to have insurance on your car. Why? To protect the bank that loaned you the money to purchase your car.

However, there’s no one requiring you to have insurance on your life. Who is going to protect your family if something happens to you?

There are certain paths in our future. One of them is passing away too early. We don’t know when or how? It’s part of the circle of life. No one gets out alive.

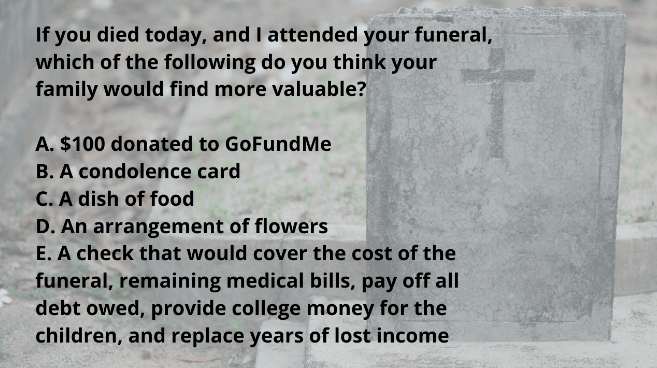

And your death should be a time for everyone to celebrate your life… not a time to be passing around a hat to help cover your burial costs.

Just as the choices you made during your lifetime greatly affected your quality of life, your choice regarding life insurance will affect the quality of life for your surviving family.

Make an informed decision with respect to life insurance. Don’t let it be one of those ‘things’ you’ll take care of later. Because if you fail to address it while you’re still alive, you will most definitely create a burden for those you love most.

As everyone is reminiscing about the marvelous life you lived, don’t let those memories be tarnished by the vision of your family wondering how they are going to pay the bills.

Life insurance is not for you… it’s from you.

No one can predict the future… But we can all prepare for it.

Everyone has an opinion about life insurance, however, most financial gurus will agree that people need life insurance as part of their financial portfolio.

Suze Orman says, “If a child, a spouse, a life partner, or a parent depends on you and your income, you need life insurance”.

Dave Ramsey says that “life insurance is one of the most vital pieces of your family’s long-term financial plan.”

Who could argue with that?

What is Life Insurance?

According to Investopedia, life insurance is a contract between an insurer (the insurance company) and a policyholder (you) in which the company guarantees payment of a death benefit to the beneficiaries you name when you die.

And as long as you pay the required premiums, the insurance company promises to pay a death benefit to your family or whomever you designate the beneficiary of your policy.

What is the Purpose of Life Insurance?

The purpose of life insurance is to provide money for your family to use to pay your bills and death expenses when you die.

While none of us know how or when we will die, we know that it will happen. Death is a foreseeable risk… a risk that the proper amount of life insurance can help you manage.

If others do rely on you financially and you don’t have life insurance, you are choosing to force others to pay for your final expenses and provide for your family. Is that what you really want?

There’s enough going on when someone dies… Do you really want them to wonder how the bills will be paid? Did you leave them instructions on how to run a successful ‘Go Fund Me’ campaign to raise the money you won’t be here to bring home for them?

Experiencing the loss of a loved one is tragic enough. Not having the money to provide for a proper send off… let alone to care for your surviving family who depend on your earnings… only adds to the grief.

Straight Talk About Life Insurance – Do You Really Need It?

Imagine what it would be like if your family wouldn’t have the financial resources to handle your final expenses. A life insurance policy could alleviate a lot of their stress if you die prematurely.

And besides, it’s the responsible thing to do:

- If you have kids >> consider the cost of getting them through their school years, and possibly through college. Your life insurance payout can cover living expenses, tuition and all the other expenses that comes with growing up.

- If you have debts >> your family will be responsible for any debt you leave behind… cover all your debt to lift that burden from your family.

- If you take care of others >> the loss of your income could be devastating… A life insurance policy can ensure that your loved ones are taken care of if you die too soon.

The primary reasons people don’t have life insurance are:

- They think it costs too much. Most people estimate the cost of insurance to be 2-3 times what it actually costs. There are some types of insurance that are extremely low in cost. You owe it to your family to check it out.

- They don’t think they can get approved. You do have to qualify for a life insurance policy. If you have health issues, it may require a bit more effort and ultimately cost a bit more; however, there are carriers that may provide the protection you’re looking for.

- They believe the group life insurance they receive through their work is sufficient. The short answer is that it’s typically not enough coverage and it only provides coverage as long as you’re working there. Worst case scenario: what happens if you get sick and lose your job (and its benefits) and then you die?

- They believe there’s plenty of time before they have to worry about getting life insurance. However, would you rather be 10-20 years early… or 5 minutes too late

What Can Life Insurance Do For Your Family?

Just think about it…

Financial peace of mind. Dealing with a loved one’s death is hard enough without having to worry about how to pay the bills, too.

Insurance allows survivors time to make sound, rational decisions…and to wait at least a year before making any drastic lifestyle changes.

You’ll have the peace of mind knowing that your loved ones will have a financial safety net when you’re gone.

Life insurance is an important consideration for anyone concerned about how their death might financially impact loved ones.

Your insurance can pay all of your final expenses — including any outstanding medical bills and funeral arrangements.

With your insurance, they can immediately pay off your current debts (including your mortgage, if it makes sense).

You can establish a fund to pay your children’s education expenses.

Your insurance will provide income for your survivor(s) for a certain period of time… or for life.

Common Uses for Life Insurance

Final Expenses

- Funeral and Burial Costs

- Medical Expenses

- Probate Fees

Protect the Family

- Replace Lost Income

- Allocate Funds for Education

- Protect Business Interests

- Financial Safety Net

Pay off Debts

- Mortgage Protection

- Any Outstanding Loans

- Consumer Debt

Pay off Taxes

- Property

- Income Taxes

- Estate Taxes

How Much Life Insurance Do You Need?

Now keep in mind that you certainly don’t want to be worth more dead than alive!

The amount of coverage that is needed can be determined by using either a “human life approach” that looks at life expectancy and income or a “needs approach” that looks at projected re-occurring and unusual costs

The basic rule of thumb is to have enough life insurance to provide approximately 10-12 times your annual income. But there are many other factors that should be taken into consideration, including your age, your medical condition, how many dependents you have, your income or current financial status, and most importantly, what do you want your life insurance proceeds to cover.

Also, you should plan for the insurance policy to stay in force for a minimum of 20-30 years… longer if you’re younger. For some, the need for insurance will last their entire life and they should definitely look at what a permanent policy can provide.

WARNING: You need both money and good health to purchase life insurance. If your health deteriorates, you may not qualify to get a life insurance policy. However, as I mentioned earlier, even if you think you may not qualify, apply anyway to find out for sure.

Insurance Basics

Life insurance enjoys favorable tax treatment unlike any other financial instrument. Death benefits are generally income-tax-free to the beneficiary.

There are two types of life insurance: Term Life Insurance and Permanent Life Insurance.

Term insurance

According to Investopedia, Term Insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified “term” of years. If you die during the time period specified in the policy and the policy is active, or in force, a death benefit will be paid.

Specific term: Annual (premium increases every year), 5yr (premium stays level for 5 years), 10yr (premium stays level for 10 years), 15yr (premium stays level for 15 years), 20yr (premium stays level for 20 years), 30yr (premium stays level for 30 years).

The pros of Term Insurance are:

- Easy to understand

- Very straightforward … Basically, renting a bag of money for a certain period of time

- Most affordable type of life insurance

- Low cost coverage for limited time

- No surprises… as long as you pay your premiums, you will have coverage during the term of the policy

- No savings or cash value – pure protection

- Living and traditional benefits

The cons of Term Insurance are:

- You lose all of your premiums if you don’t die during the term

- The term that you select may not be long enough

- If there is still a need for insurance, you may not be able to qualify for insurance coverage when the current term ends.

With term life insurance, all of your payments are put toward the death benefit for your beneficiaries, with no cash value. There is no savings component. This means you are paying smaller premiums in exchange for a larger death benefit for a specific time period.

The majority of policyholders with term life insurance do not die during the policy term… that’s the reason these policies are inexpensive.

This is what I would call a ‘win-win’. You win because you’re still alive… and the insurance company wins because they made a little money over the term of the policy and did not have to pay out a death benefit!

Permanent Insurance

Permanent insurance is insurance…NOT an investment! Don’t ever forget that!

Permanent Insurance is a hybrid. It provides both life insurance coverage, as well as the ability to have money accumulate in a cash value account.

This is not an investment! It’s a ‘deposit’ product much like putting money in a bank savings account; however, the money is going into an account with the life insurance company.

The cash value component grows tax-deferred. There are strategies involving different ways to access your cash value… and potentially get your cash value paid out to you tax-free.

Because a permanent policy will ultimately pay off (we will die some day!), as long as you continue to pay the premiums as stipulated in the policy, the insurance company cannot cancel your policy and your beneficiaries with be paid the death benefit.

Group Insurance

Group Insurance is a type of term insurance. The term of the group policy is the length of your employment.

Today, more workers are covered by group life insurance than private policies. However, employer-provided coverage is typically not nearly enough to protect most households, and it provides a false sense of security.

Smaller firms tend to offer a flat dollar amount, maybe $25,000 to $50,000. And firms with at least 100+ employees typically offer a multiple of salary; one times salary is common, though sometimes generous employers offer up a two times or three times free life insurance benefit.

But, what happens if your health deteriorates? You leave your job (either by choice, or someone else makes the choice for you) and your group insurance stays with your job. You may not qualify anymore (because of health issues) and your premiums will always be higher the longer you wait to get your own coverage (and lock it in).

Group Insurance through work is nice, but it’s typically not enough. You absolutely need to have insurance that you own and control. You neither own nor control your group insurance policy. Treat your group insurance as icing on the cake.

Living Benefits…

Some insurance policies provide accelerated or living benefits. This allows you access to some of the death benefit while you’re still living.

You can use the living benefits to pay your medical bills and possibly enjoy a better quality of life in your final months. It may offer living benefits that can protect a family in the case of certain chronic, critical or terminal illnesses.

The downside is that your beneficiaries won’t receive the full death benefit you intended when you took out the policy.

Bottom Line

Now let all of this sink in for a moment.

Insurance is designed to protect against foreseeable risks so you don’t have to turn to “begging for money” (“GoFundMe”). We know that we are going to die at some point… death is a foreseeable risk. Life insurance is the perfect solution for most to protect themselves and their families against the financial calamity that death can cause.

If you knew death would occur tomorrow, how much life insurance would you get today?

Would you want your family to live the same lifestyle, a better lifestyle, or a worse lifestyle economically when you die?

If you have no other reason, love insurance because you love your family, and you want to ensure that they are always provided for despite any catastrophe.

Remember, life insurance is a critical piece of your long-term financial blueprint. The more you learn about life insurance and how money works, the better your financial decisions will be.

And that’s it! Don’t leave your financial future to chance. I would love to hear what you decided would be best for you and your family. Let me know how I can help.

Leave a Reply